After the October inflation report, I wrote that “one month does not make a trend.” After the November report, I wrote that we have the “making of a trend.”

We now have a trend!

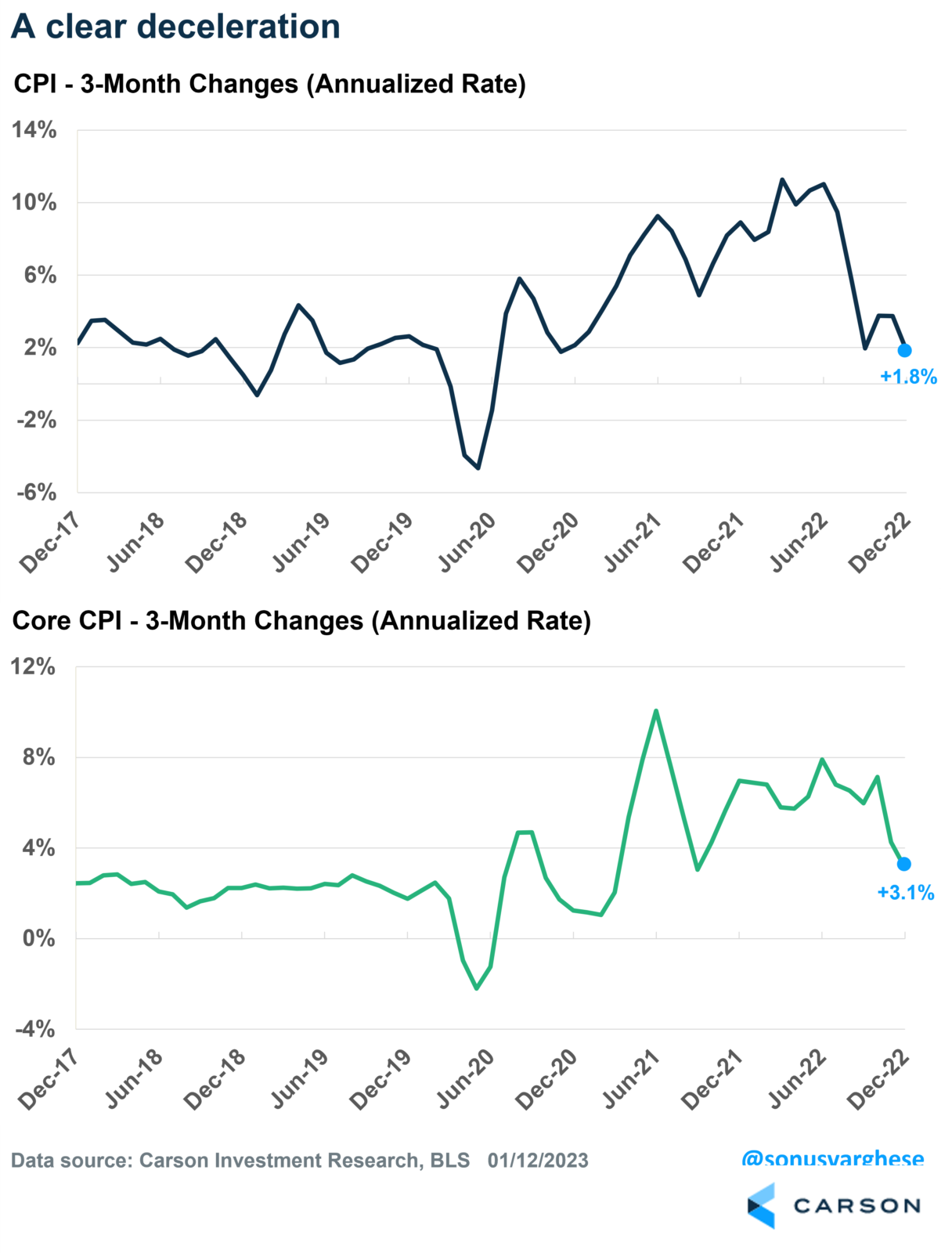

Headline inflation fell 0.1% in December, the slowest pace since May 2020. Inflation has now decelerated to 6.5% year-over-year, quite a pullback from the 9.1% level we saw six months ago. Core inflation rose 0.3%, in line with expectations. On a 3-month annualized basis, headline and core CPI are currently running at a 1.8% and 3.1% pace, respectively.

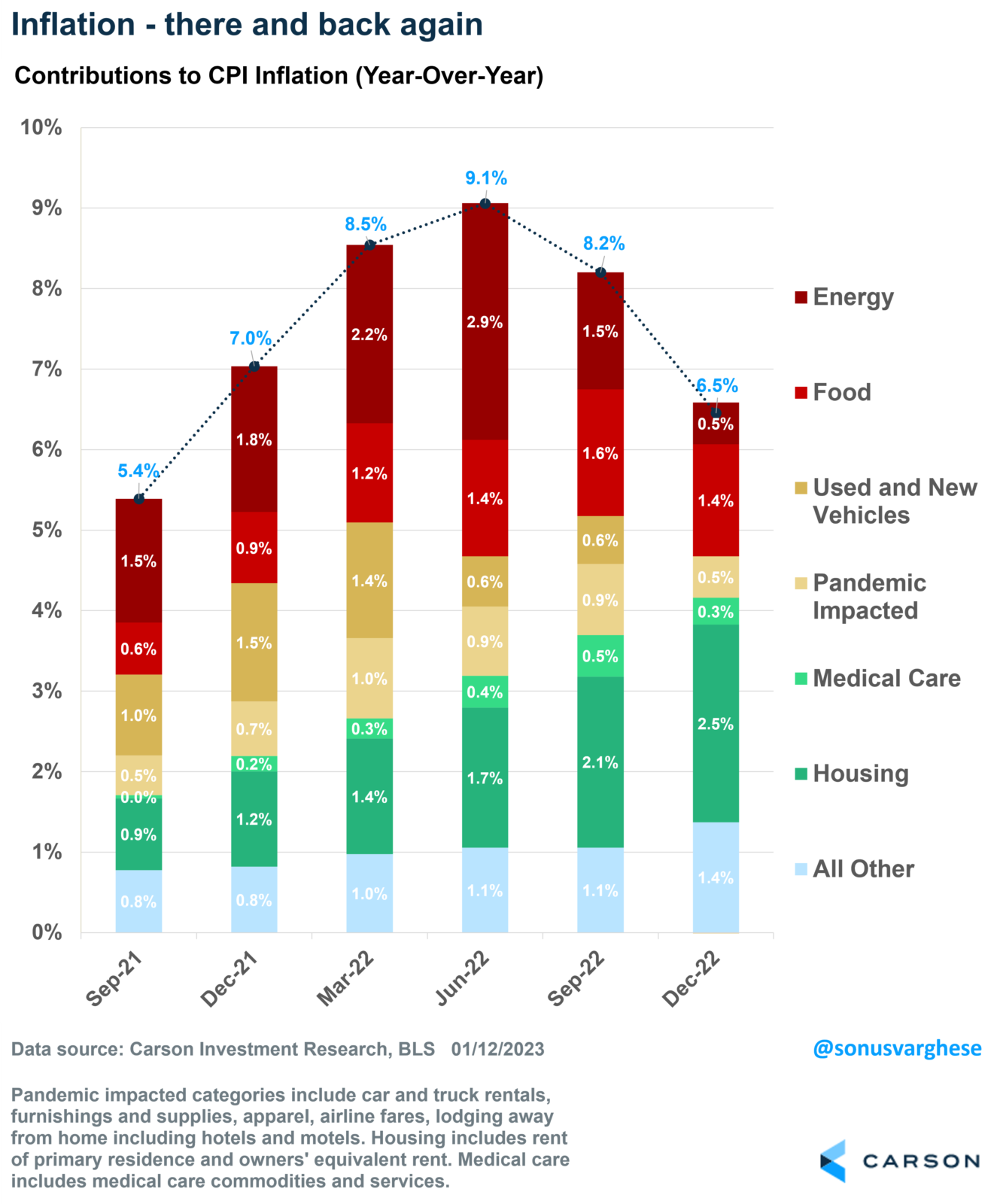

The big driver has been falling energy prices. Gas prices at the pump fell 9.4% in December and are 1.5% lower than a year ago. The even better news is that inflation is falling more broadly now.

- Food inflation continues to decelerate, rising just 0.3% in December—the slowest pace since March 2021.

- Core goods prices, excluding food and energy, fell 0.3% in December—the third consecutive month of price declines.

- A significant factor was used car prices, which fell 2.5% in December and are almost 9% lower than a year ago.

- New vehicle prices fell 0.1%, the first monthly decline in 2 years and a welcome one.

- Pandemic-impacted services like vehicle rentals and airfares are also seeing less price pressure now.

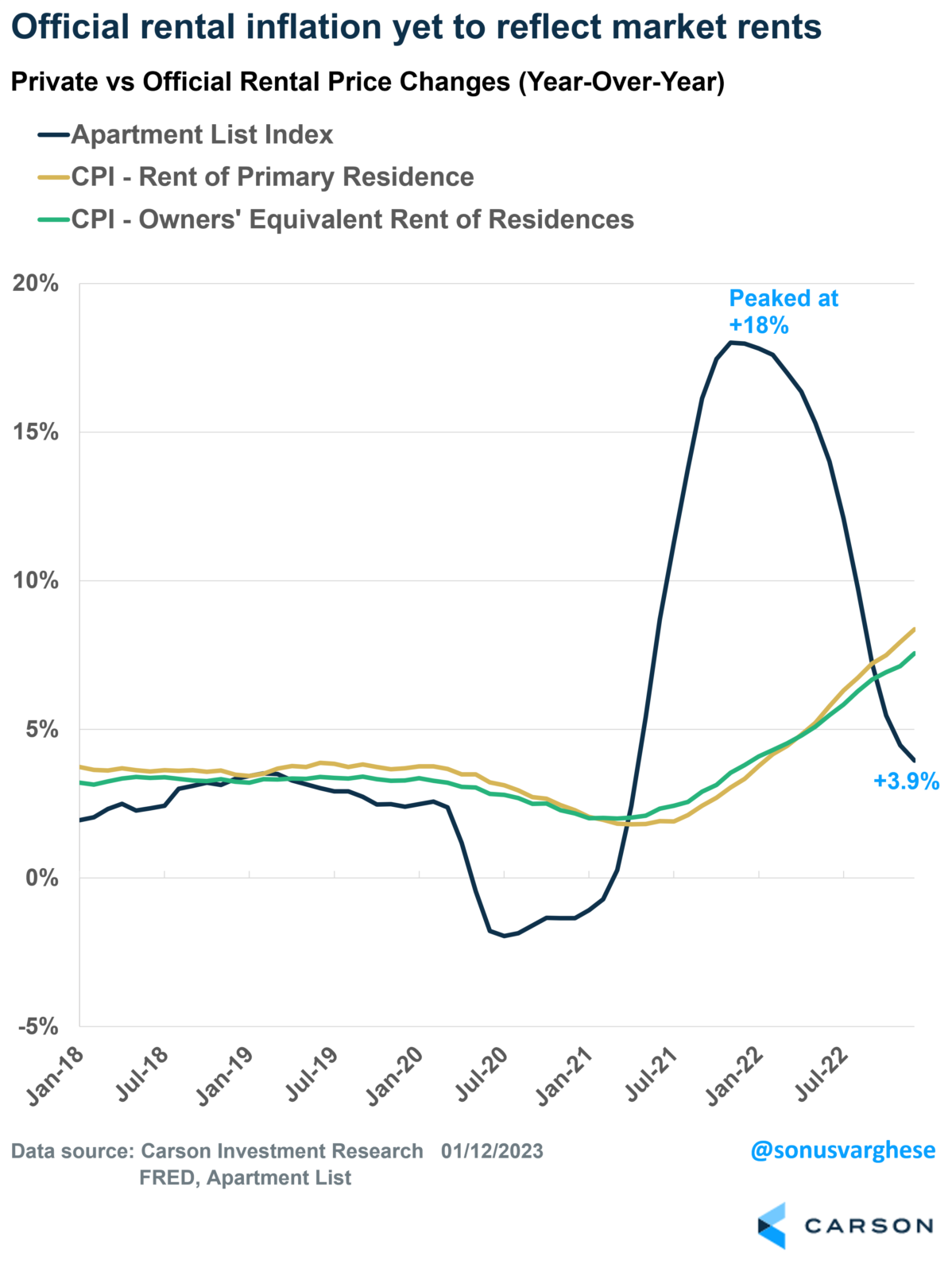

As you can see above, what’s keeping pressure on prices is the dark green bar, which represents housing. My colleague Ryan Detrick and I have written quite a bit about how official housing inflation data lags market rents (see here and here). The good news:

- Housing inflation looks to have peaked.

- Market rents are decelerating rapidly, which will eventually show up in the official data, albeit with an 8-10 month lag.

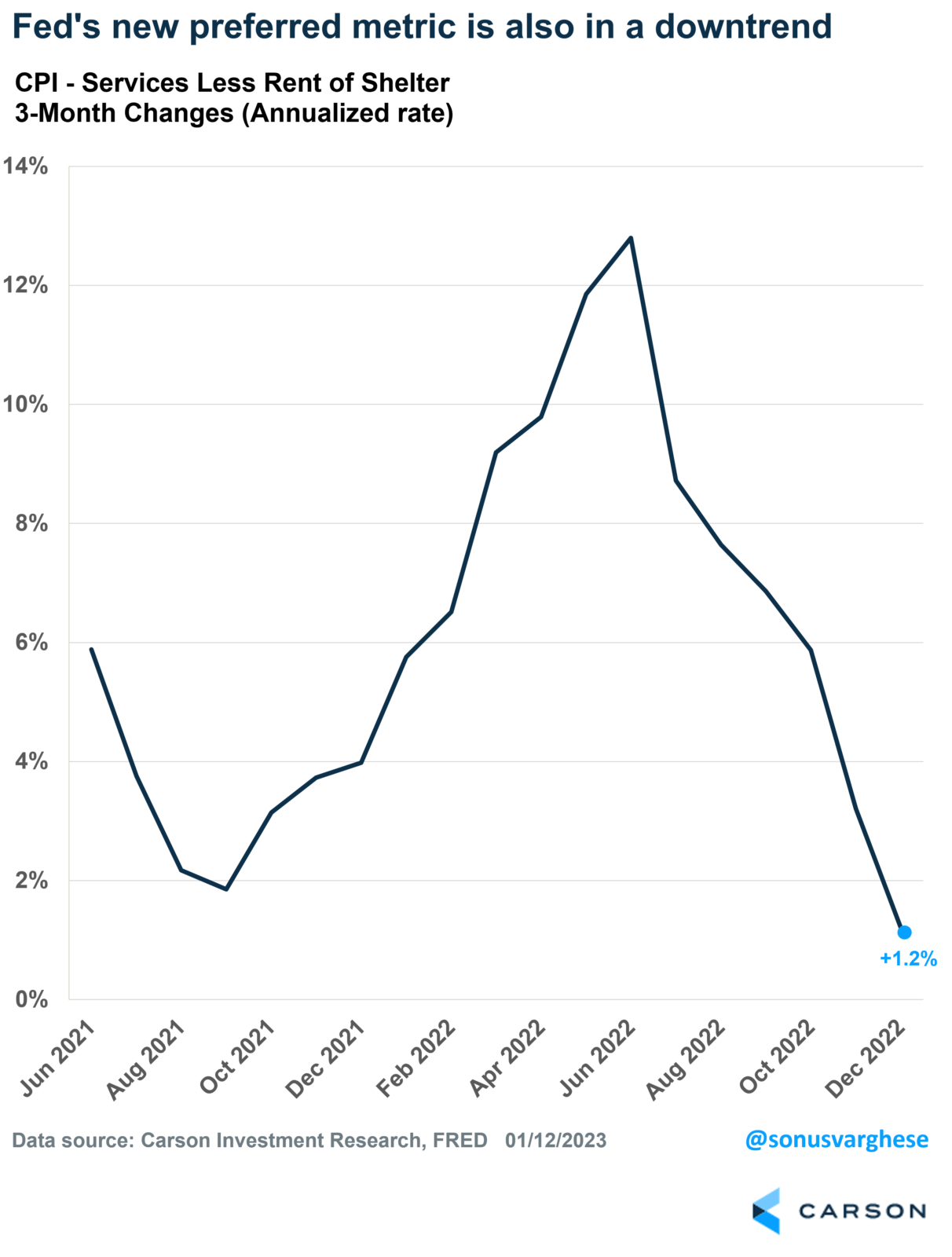

What’s interesting is that Fed Chair Powell acknowledged these factors in his press conference after the December FOMC meeting, namely falling energy prices, core goods prices, and the issues around official housing inflation data. Yet, he went on to say that services inflation, excluding housing, remains a concern since that is highly correlated with wage growth. And since wage growth is running hotter than pre-pandemic, that implies this measure of “underlying inflation” is also too high.

Well, the data indicates that services less rent of shelter inflation is also in a downtrend. Over the last three months, this measure has risen at an annualized pace of 1.2%. Primarily thanks to falling health insurance premiums.

At the same press conference, Powell said that “price pressures remain evident across a broad range of goods and services.”

At this point, we can say that is not the case. However, this is not to say that inflation cannot rear its ugly head again if there is a shock—like the Russian invasion of Ukraine last year, which sent energy prices soaring, or a new snag in supply chains.

In lieu of that, the Fed will eventually have to acknowledge that price pressures are easing. The obvious implication is that they need not maintain policy at such a restrictive level in that case. At least in the bond market, this is what investors are betting will happen—with rate cuts priced for the back half of 2023.