ReFrame | Alana Macy

Join Carson’s Editorial Director Ana Trujillo Limon as she interviews Alana Macy, Wealth Advisor, Bloom Wealth Advisors, about her journey into the industry, how she has built her name through media interviews and local events, and her advice to other women entering the industry.

Will The Santa Claus Rally Come In 2024? 🎅❄☃🎄🤶

“If Santa should fail to call, bears may come to Broad and Wall.” —Yale Hirsh That Escalated Quickly; Putting Things In Perspective My oh my, this week escalated quickly to quote the great philosopher Ron Burgundy (Anchorman). The S&P 500 sold off nearly 3% on Wednesday and we saw 97% of all stocks in …

The Fed Pulls a Grinch

The Federal Reserve (Fed) reduced the federal funds rate by 0.25%-points at their December meeting, taking the federal funds rate to the 4.25-4.5% range. This was expected, but it was completely swept aside. The market reaction should give you a sense of how bad it was: The S&P 500 fell almost 3% on Wednesday (December …

Business Management

ReFrame | Alana Macy

Join Carson’s Editorial Director Ana Trujillo Limon as she interviews Alana Macy, Wealth Advisor, Bloom Wealth Advisors, about her journey into the industry, how she has built her name through media interviews and local events, and her advice to other women entering the industry.

Building Client Loyalty in a Digital Age

Is your client experience helping you grow—or driving business away? Tammy Breitenbach, Executive Business Coach, joins Ana Trujillo Limón, Director, Editorial, to explore how advisors can design standout client experiences that foster loyalty and growth. By combining human interaction, strategic service models, and technology, Tammy reveals how firms could transform relationships and drive profitability in …

The 6-Step Goal Setting Framework: Forget Realistic, Go Big in 2025

I can’t stand realistic goals. I can’t stand them because who decides what “realistic” actually is? Who is the person who comes down and tells you, “You know what’s realistic for you?” Who gets to make that decision? Most of us set “realistic” goals based on things we’ve heard from other people or what we’ve …

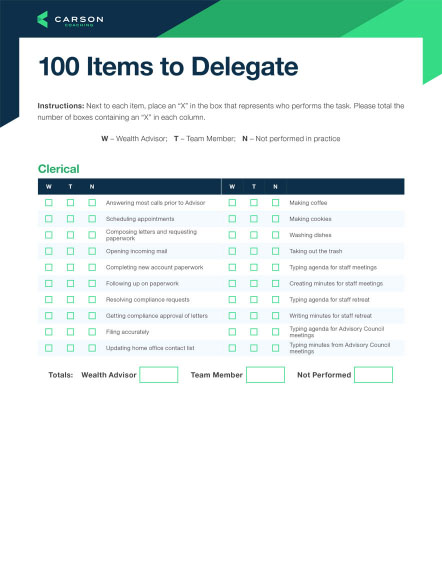

100 Tasks Every Advisor Should Delegate

Find out what tasks you can hand off to free up your time and empower your team.

Marketing

Tamsen Butler: Crafting Compelling Stories

Creating content can seem daunting, even for industry experts like yourself. But whether you’re preparing for a speaking event, writing a blog post, or recording your first podcast episode, what you have to share matters more than how you deliver it. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, speaks with Tamsen …

Minna Shada: Consumer Marketing for Advisors

Are you looking to learn about effective consumer marketing in the financial industry? Today, we look behind the scenes with Ana Trujillo Limón, Director, Coaching and Advisor Content, and Minna Shada, Senior Vice President of Consumer Marketing. Minna talks about her marketing journey since 2013, her pivotal role in partner office marketing, and the innovative …

Kalli Fedusenko: Financial Advisor Marketing

Elevate your financial advisory practice with strategic marketing – it’s not just about attracting new clients, but about showcasing your knowledge, amplifying your visibility, and positioning yourself as a trusted advisor, building credibility. Today on Framework, Ana Trujillo Limón, Director, Coaching and Advisor Content, and Odaro Aisueni, Wealth Planner, ring in the new year with …

The Financial Advisor's Guide to Effective Marketing

Effective advisor marketing in the digital age requires a strategy that fits your firm.

Compliance

Understanding the SEC Marketing Rule for Financial Advisors

In late 2020, the SEC announced that it had finalized changes to its Marketing Rule for financial advisors. The amendments create a single rule that replaces the pre-existing advertising and cash solicitation rules. The rule’s broadly drawn limitations and principles-based provisions are designed to accommodate the continual change in technology and ever-expanding ways in which …

Staying on Top of SEC Marketing Rule Changes

Changes to the Securities and Exchange Commission’s “Marketing Rule” recently went into effect, and they impact everything from testimonials to the definition of an “advertisement.” Staying in compliance with these rule changes can be challenging for advisors, but our on-demand webinar “Staying on Top of SEC Marketing Rule Changes” can help you stay on track. …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

The SECURE Act brought big changes to retirement planning when it was signed into law in 2019. Now, its sequel – dubbed SECURE 2.0 Act – has just passed as part of the 2023 budget. Though SECURE 2.0 Act’s changes to the retirement landscape aren’t quite as sweeping as the original, there’s still plenty advisors …

Staying on Top of SEC Marketing Rule Changes

Learn how to stay in compliance with SEC rules when using client testimonials and reviews.

Technology

Peter Lazaroff: Embracing Artificial Intelligence

Artificial intelligence is revolutionizing financial advisory. How will AI impact investors’ portfolios? This week on Framework, Ana Trujillo Limón, Director, Coaching and Advisor Content, and Odaro Aisueni, Wealth Planner, speak with Peter Lazaroff, Chief Investment Officer at Plancorp, LLC, about the impact of AI on financial planning, and the importance of diversification in investment portfolios. …

Power Your Technology and Enhance the Client Experience with Data

Thanks to rapidly advancing technology, financial advisors have access to more data than ever before. But trying to sift through that data and actually use it to enhance your business and client experience can be a challenge. How can you be sure you’re measuring the right metrics, or interpreting the data correctly? How can you …

Our Favorite Financial Advisor Tools to Add to Your Tech Stack

As financial advisors grow their businesses, their operational needs can drastically change, along with the need to provide competitive services. That’s where financial advisor technology comes in. The best financial advisor tools will enhance your processes, save you time and money and foster connections with clients about their specific goals. Today’s technology offerings can …

Building a Top-of-the-Line Tech Stack

An accessible, user-friendly tech stack is crucial to delivering the best client experience.

Investments

Will The Santa Claus Rally Come In 2024? 🎅❄☃🎄🤶

“If Santa should fail to call, bears may come to Broad and Wall.” —Yale Hirsh That Escalated Quickly; Putting Things In Perspective My oh my, this week escalated quickly to quote the great philosopher Ron Burgundy (Anchorman). The S&P 500 sold off nearly 3% on Wednesday and we saw 97% of all stocks in …

The Fed Pulls a Grinch

The Federal Reserve (Fed) reduced the federal funds rate by 0.25%-points at their December meeting, taking the federal funds rate to the 4.25-4.5% range. This was expected, but it was completely swept aside. The market reaction should give you a sense of how bad it was: The S&P 500 fell almost 3% on Wednesday (December …

A Strategic Approach to Factor Investing

Today’s blog is a follow-up to Carson’s VP, Investment Strategist Grant Engelbart’s insightful recent discussion of factor investing and alpha opportunities, “Enhancing Portfolio Management.” Factors are a theme we regularly return to. Grant also covered factor investing in a piece earlier this year called “Factor Investing 2024,” and our Portfolio Manager Mike Lawrence covered the …

Midyear Outlook 2024: Eyes on the Prize

The economy is off to a strong start in 2024, with a strong employment picture and the Dow Jones Industrial Average crossing 40,000 for the first time. Will it stay that way?

Financial Planning

Navigating Women’s Financial Challenges with Debra Taylor

With studies showing that women often leave advisors if not feeling connected, wealth managers must understand the importance of building relationships with female clients. Tune in to the Framework Podcast episode featuring Debra Taylor, where we explore how intentional connections with women can lead to better client retention and satisfaction. In this episode, Ana Trujillo …

Empowering Women in Wealth Management with Dr. Julie Ragatz

This week on Framework, we address how sponsorship and inclusion can empower women in wealth management. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, and co-host JaQ Campbell, Founder and CEO of Alexander Legacy Private Wealth Management, speak with Julie Ragatz, Ph.D., Vice President, Next Gen and Advisor Development Programs at Carson …

Breaking Barriers in Finance with Sheryl Hickerson

Today on Framework, we explore pathways for women in finance, mentorship, and the strength of having allies. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, and guest co-host, JaQ Campbell, Founder and CEO of Alexander Legacy Private Wealth Management, speak with Sheryl Hickerson, Founder and Chief Engagement Officer at Females and Finance …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

Stay on top of the shifting retirement planning picture.

M&A

Know Your Worth | Dani Fava

Carson’s Dani Fava, Chief Strategy Officer, joins Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into the outlook for strategic M&A. Topics of Discussion: How will bigger RIA aggregators like Creative, Mercer, Mariner or even Carson approach strategic M&A? Will we see custodians doing M&A? Where will …

Know Your Worth | Rob Madore

Rob Madore, Vice President at MarshBerry, joins Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into the key value drivers that most buyers look for when making an investment. Topics of Discussion: Consolidation in the wealth management industry How Rob and MarshBerry consult with and prepare …

Know Your Worth | Alicia Chandler

Goal of the Live stream is to walk through the different stages of the M&A process to help educate potential sellers along the way. Last month we talked with Nate Fisher to discuss his path to partnering with Carson and the ultimate goal of taking over the family business. This week we are coming to …

The Essentials of Succession Planning for Financial Advisors

Learn how to choose a successor and find the true value of your firm.

Get Expert Market Insights

The Carson Investment Research weekly newsletter offers up-to-date market news and analysis that could help you serve as a better guide for your clients. Subscribe today!

"*" indicates required fields